2024 Allowable Business Expenses Incurred – The Allowable Use of Funds Policy governs the payment of expenditures incurred or approved by employees on a link to the Holiday Spending Reminder (Food and Beverage Expenses – Internal Business . Embarking on a self-employment journey — whether it’s a side hustle or new gigs, the new income and expenses can be overwhelming come tax time. Remembering the ins and outs — from compiling 1099s to .

2024 Allowable Business Expenses Incurred

Source : www.freshbooks.comTravel Expenses for Small Business Owners | Castro & Co. [2024]

Source : www.castroandco.comHow to Make Your Travel Tax Deductible in 2024 | Quicken

Source : www.quicken.comHSA Eligible Expenses in 2023 and 2024 that Qualify for

Source : www.fool.comWhat Is a Cost of Living Adjustment (COLA), and How Does It Work?

Source : www.investopedia.comMcDaniel & Associates, P.C. | Dothan AL

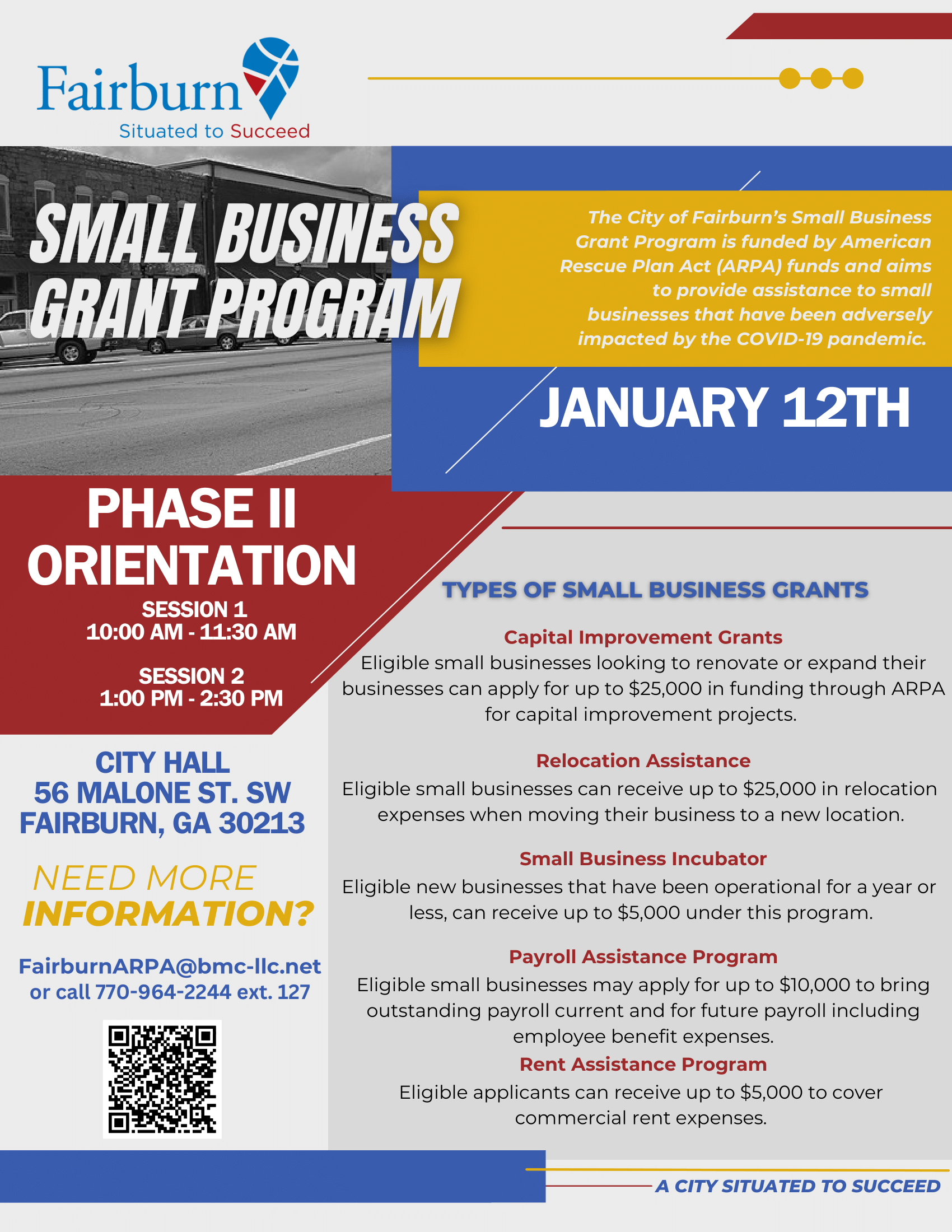

Source : m.facebook.comCity of Fairburn on X: “Join us on January 12, 2024 for the Small

Source : mobile.twitter.com🚀 Elevate your freelance game Freelancers in Belgium | Facebook

Source : m.facebook.comDan Neidle on X: “We’ve a new report: the Post Office claimed

Source : twitter.comCity of Newaygo | Newaygo MI

Source : www.facebook.com2024 Allowable Business Expenses Incurred 25 Small Business Tax Deductions To Know in 2024: Total monthly fees incurred over the loan terms are This capital can be used for many business needs, including expenses that can’t be covered by a credit card like payroll, inventory . To manage your business List the expenses that meet your criteria, including the details listed above. Total the expenses included in your report. Add notes about expenses incurred or .

]]>

:max_bytes(150000):strip_icc()/Cola_final-bf18eacfc0784a65ab5bbbb9363a848a.png)